Brain Computer Interface Market Size, Share & Trends by Product (Non-invasive, Invasive, Partial invasive), Technology (EEG, MEG, ECoG, fMRI), Application (Disability/Rehabilitation, Assistive technologies, Mental health, Research), End User - Global Forecast to 2029

Brain Computer Interface Market Size, Share & Trends

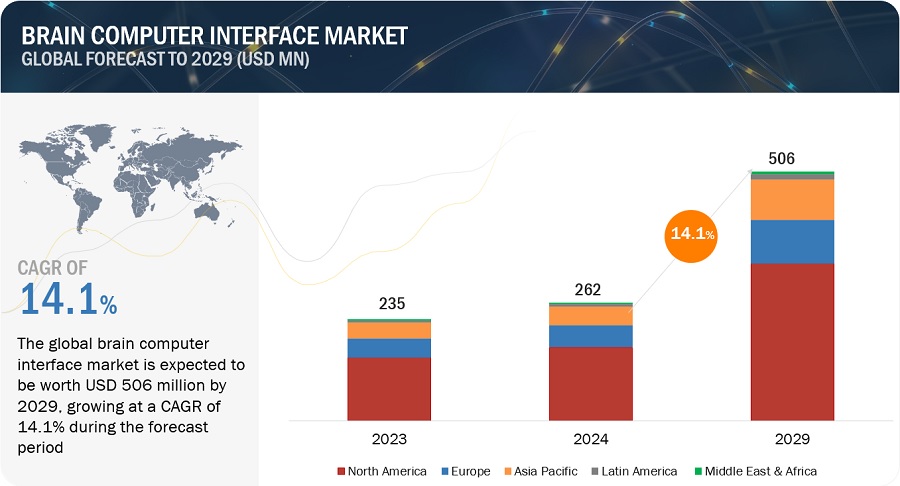

The size of global brain computer interface market in terms of revenue was estimated to be worth $262 million in 2024 and is poised to reach $506 million by 2029, growing at a CAGR of 14.1% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The growth of the brain computer interface market is mainly driven by the increasing demand for non-invasive and wearable BCI devices and rising Investments in research and development.

Brain Computer Interface Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Brain computer interface industry Dynamics

DRIVER: Growing need to minimize medication errors

The prevalence of various neurological disorders, encompassing stroke, Alzheimer's disease, Parkinson's disease, and amyotrophic lateral sclerosis (ALS). These conditions affect millions of people globally, limiting mobility, communication, and independence. This escalation is primarily linked to the expanding elderly population, with projections indicating that over 20% of the global populace will be above 65 by 2050. Forecasts from the American Medical Association (AMA) suggest that by 2030, approximately 60% of individuals in this age bracket will contend with multiple chronic conditions.

The growing incidence of these neurological disorders underscores the critical need for BCI solutions. BCIs offer a novel approach to address these unmet needs. They can help individuals with neurological disorders regain control of prosthetic limbs, operate assistive technologies, and even communicate through brain signals. As BCI technology advances and clinical applications become more widespread, the market is poised for continued growth in the years to come.

RESTRAINT: High cost of brain computer interface systems

The high initial investment required for acquiring and implementing BCI technology poses a significant barrier to entry for many potential users. This cost factor not only affects individual consumers but also dissuades healthcare facilities, research institutions, and other organizations from adopting BCI solutions on a larger scale. The high cost of BCI systems limits accessibility to BCI technology, particularly for individuals and organizations with budget constraints or limited financial resources.

Moreover, the total cost of ownership for BCI systems extends beyond the initial purchase price and includes expenses related to installation, training, maintenance, and ongoing support. These additional costs further compound the financial burden associated with adopting BCI solutions. As a result, many potential users may hesitate to invest in BCI technology, leading to slower market growth and adoption rates than anticipated.

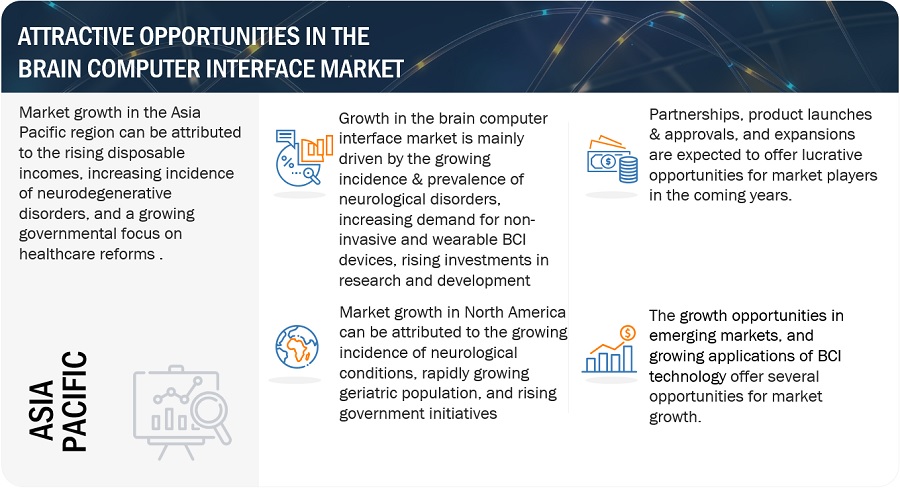

OPPORTUNITY: Growth opportunities in emerging markets

The burgeoning economies of emerging markets present lucrative prospects for players within the brain computer interface sector, primarily fuelled by the significant rise in demand for advanced healthcare solutions, including BCI systems, to address the growing burden of neurological disorders and disabilities. Notably, nations like Brazil, Russia, India, China, and South Africa have emerged as some of the world's fastest-growing economies, poised to collectively contribute to a third of the global healthcare expenditure by 2022, as per the World Economic Forum.

Emerging markets present an opportunity to develop low-cost and scalable BCI solutions tailored to the specific needs and budgetary constraints of these regions. Moreover, the regulatory landscape in developing nations tends to be less stringent, with lower data requirements. Particularly in the Asia-Pacific region, regulatory policies are perceived as more adaptable and conducive to business, garnering favor among market players. Consequently, the market players are increasingly focusing on expanding their presence and operations in these regions to capitalize on the burgeoning opportunities.

CHALLENGE: Shortage of trained medical professionals

Trained medical personnel are required to operate BCI systems effectively for rehabilitation. The positioning of electrodes on the scalp and the insertion of muscular needles require accuracy and must be performed only by highly-trained personnel. The presence of highly skilled medical personnel and staff is, therefore, vital for the effective use of BCI systems.

Skilled medical personnel are currently in short supply worldwide, with the WHO estimating a shortage of 4.3 million physicians, nurses, and other health professionals. In the US, the Association of American Medical Colleges (AAMC) predicts a shortfall of up to 124,000 physicians by 2034 due to factors like population growth and aging. The Canadian Nurses Association predicted that Canada was expected to lack around 60,000 nurses by 2022. Additionally, there's a global shortage of neurodiagnostic technologists, prompting hospitals to train other allied health professionals. This poses a significant obstacle to the expansion of the global brain-computer interface market.

Brain computer interface industry Ecosystem

The Brain computer interface market ecosystem comprises entities responsible for delivering these solutions to end users.

The ecosystem comprises of manufacturers of brain computer interface solutions, research institutions, investors & venture capital firms, healthcare providers, healthcare professionals, patient and caregivers, and governments and regulatory bodies.

Hardware is the largest component of the brain computer interface industry in 2023, by component.

Based on component, the brain computer interface market is segmented into hardware and software. The hardware segment accounted for the largest share of the brain computer interface market in 2023. Hardware forming the foundational backbone of BCI functionality, providing essential components like EEG headsets, neural implants, and sensors vital for capturing and processing neural signals and significant investments will fuel the demand for BCI hardwares.

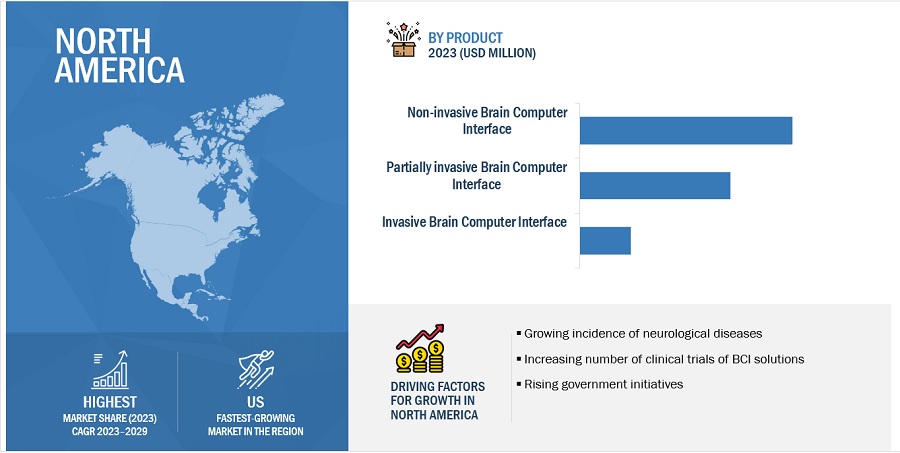

The non-invasive brain computer interface segment accounted for the largest share of the brain computer interface industry, by product type.

Based on product type, the brain computer interface market is segmented into non-invasive brain computer interface, partially invasive brain computer interface, and invasive brain computer interface. Among these, non-invasive brain computer interface segment accounted for the largest share of the brain computer interface market in 2023, attributing to the rising prevalence of neurological diseases, and reduced risks associated with surgical implants.

The electroencephalography (EEG) segment accounted for the largest share in the brain computer interface industry , by technology.

Based on technology, the brain computer interface market is segmented into Electroencephalography (EEG), Functional Magnetic Resonance Imaging (fMRI), Magnetoencephalography (MEG), Electrocorticography (ECoG), and Functional Near-Infrared Spectroscopy (fNIRS). The electroencephalography (EEG) segment accounted for the largest share of the market in 2023, attributing to the growing R&D in the field of cerebral and spinal disorders, and significant adoption of EEG among researchers.

North America accounted for the largest share of the brain computer interface industry in 2023.

To know about the assumptions considered for the study, download the pdf brochure

Based on the region, the brain computer interface market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America accounted for the largest share of the brain computer interface market in 2023. This is due to the growing incidence of neurological diseases, an increasing number of clinical trials of BCI solutions, and the rising government initiatives.

Prominent players in brain computer interface market include Advanced Brain Monitoring, Inc. (US), ANT Neuro (Netherlands), Bitbrain (Spain), MindMaze (Switzerland), Cortec GmbH (Germany), Kernel (US), Paradromics (US), BrainCo (US), Blackrock Neurotech (US), g.Tech Medical Engineering GmbH (Austria), Emotiv (US), Neurosky (US), Brain Products GmbH (Germany), CGX (US), Ripple Neuro (US), Neurable (US), InteraXon (US), Open BCI (US), Neurolutions, Inc. (US), BirgerMind (Latvia), Cognixion (US), Artinis Medical Systems (Netherlands), AAVAA Inc. (Canada), Nexstem (India), and Conscious Labs (France).

Scope of the Brain Computer Interface Industry

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$262 million |

|

Projected Revenue by 2029 |

$506 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 14.1% |

|

Market Driver |

Growing need to minimize medication errors |

|

Market Opportunity |

Growth opportunities in emerging markets |

The study categorizes the Brain computer interface market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Hardware

- Software

By Product Type

- Non-Invasive Brain Computer Interface

- Partially Invasive Brain Computer Interface

- Invasive Brain Computer Interface

By Technology

- Electroencephalography (EEG)

- Functional Magnetic Resonance Imaging (fMRI)

- Magnetoencephalography (MEG)

- Electrocorticography (ECoG)

- Functional Near-Infrared Spectroscopy (fNRIs)

By Application

- Disabilities Restoration/ Rehabilitation

- Assistive Technologies

- Other Applications

By End User

- Hospital & Clinics

- Rehabilitation Centers

- Home Care Settings

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- GCC Countries

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global brain computer interface market?

The global brain computer interface market boasts a total revenue value of $506 million by 2029.

What is the estimated growth rate (CAGR) of the global brain computer interface market?

The global brain computer interface market has an estimated compound annual growth rate (CAGR) of 14.1% and a revenue size in the region of $262 million in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

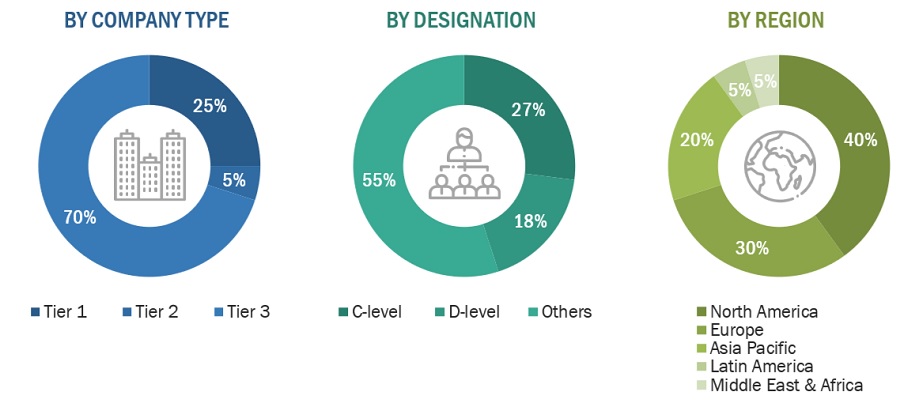

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the medical robots market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the brain computer interface market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the brain computer interface market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global brain computer interface market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital personnel, department heads, hospital directors, corporate personnel) and supply side (such as C-level and D-level executives, technology experts, software developers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Breakdown of Primary Interviews

Note 1: Tiers are defined based on the total revenues of companies. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global brain computer interface market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the global brain computer interface market were identified through secondary research, and their global market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports and regulatory filings, data books of major market players, and interviews with industry experts for detailed market insights.

- All percentage shares, splits, and breakdowns for the global brain computer interface market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report.

Global Brain Computer Interface Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Brain Computer Interface Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the brain computer interface market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical robots market.

Market Definition:

Brain-computer interface (BCI) refers to a technology that enables direct communication between the human brain and external devices, such as computers or prosthetic limbs, without the need for traditional input methods like keyboards. BCIs typically utilize various methods to capture the electrical activity generated by the brain utilizing different approaches such as electroencephalography (EEG) magnetoencephalography (MEG), functional near-infrared spectroscopy (fNIRS) or invasive neural implants, to interpret a user's intentions or commands. This allows individuals to interact with technology using only their thoughts or brain activity.

The BCI market encompasses the development, manufacturing, and deployment of these BCI systems and related technologies for various applications.

Key Stakeholders:

- Manufacturers of brain computer interface solutions

- Suppliers and distributors of brain computer interface solutions

- Third-party refurbishers/suppliers

- Clinical settings

- Educational institutions

- Group purchasing organizations (GPOs)

- Academic research centers and universities

- Corporate entities

- Rehabilitation centers

- Market research & consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists & investors

Report Objectives

- To define, describe, and forecast the brain computer interface market by component, product type, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall brain computer interface market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the market and comprehensively analyze their market shares and core competencies2

- To forecast the size of the market segments with respect to five main regions: North America, the Asia Pacific, Europe, Latin America, and the Middle East & Africa

- To track and analyze competitive developments, such as partnerships, product launches & approvals, and expansions

- To benchmark players within the brain computer interface market using the Competitive Evaluation Matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Additional Company Profiling

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe brain computer interface market into Switzerland, Russia, and others

- Further breakdown of the Rest of Asia Pacific brain computer interface market into South Korea, Singapore, and others

Growth opportunities and latent adjacency in Brain Computer Interface Market